monterey county property tax rate 2021

Salinas California 93902. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomonterey.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

. B Los Angeles County Monterey Park CA 91755. When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. Monterey County Property Tax Due Dates.

Certified Values By Tax Rate Area. Checks should be made payable to. Los Angeles County Monterey Park CA 91755.

The Monterey County Sales Tax is collected by the merchant on all qualifying. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. Single Family Dwelling with GuestGranny Unit and Bath.

July 2 Nov. Monterey County Treasurer - Tax Collectors Office. When contacting monterey county about your property taxes make sure that you are contacting the correct office.

We invite you to our office for information and assistance. Total tax rate Property tax. At DSS we are committed to promoting a caring service community.

What is the sales tax rate in Monterey County. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Period for filing claims for Senior Citizens Tax Assistance.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. You can learn much more about whom we are and the services we provide at this website. 240 North Sierra Vista Street Unit.

This is the total of state and county sales tax rates. 630 pm pdt apr 8 2020. Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes.

168 West Alisal Street. California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes. The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the activities.

The California state sales tax rate is currently 6. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Monterey County California is 775.

Monterey County Property Tax Due Dates. July 1 Oct. Welcome to the Monterey County Department of Social Services DSS webpage.

This is the total of state and county sales tax rates. Just type in the exact address in the search bar below and instantly know the targeted propertys bill for the latest tax year. The minimum combined 2022 sales tax rate for Monterey County California is.

Get driving directions to this office. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. For an average home valued at 405000 in Waterloo this works out to about 442827year in property taxes.

Easily run a rapid Monterey County CA property tax search. Start of the Countys fiscal year. Period during which County Board of Equalization accepts applications for appealing property values on regular assessment roll.

At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review. The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. Monterey County Tax Collector. The Monterey California sales tax is 875 consisting of 600 California state sales tax and 275 Monterey local sales taxesThe local sales tax consists of a 025 county sales tax a 100 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. When you have completed the E-Filing process you should printsave a final copy of your Property Statement for your own records. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax.

Medina Director of Monterey County DSS 06032021. 3 Sign up to receive home sales alerts in Monterey Park. The Monterey County sales tax rate is 025.

The median property value of homes in monterey county is 393300. Welcome to the E-Filing process for Property Statements. Ad Find Monterey County Online Property Taxes Info From 2021.

Deadline for the Tax Collector to mail tax bills. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Monterey County Treasurer - Tax Collectors Office. 025 lower than the maximum sales tax in CA.

The Monterey Sales Tax is collected by the merchant on all qualifying. In 2021 the residential tax rate is 1093399 percent. Friday December 10 2021 Be sure to mail your tax payments.

This table shows the total sales tax. The second payment is due September 1 2021. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division. For assistance in locating your ASMT number contact our office at 831 755-5057. 2022 Property Statement E-Filing E-Filing Process.

The Trustee acts as the countys banker and also collects county taxes. Where do Property Taxes Go. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomonterey.

Secured Property Taxes Tax Collector

How To Calculate Property Tax And How To Estimate Property Taxes

Additional Property Tax Info Monterey County Ca

Properties Luxury Real Estate Mansions For Sale Florida Mansion Mansions Lakefront

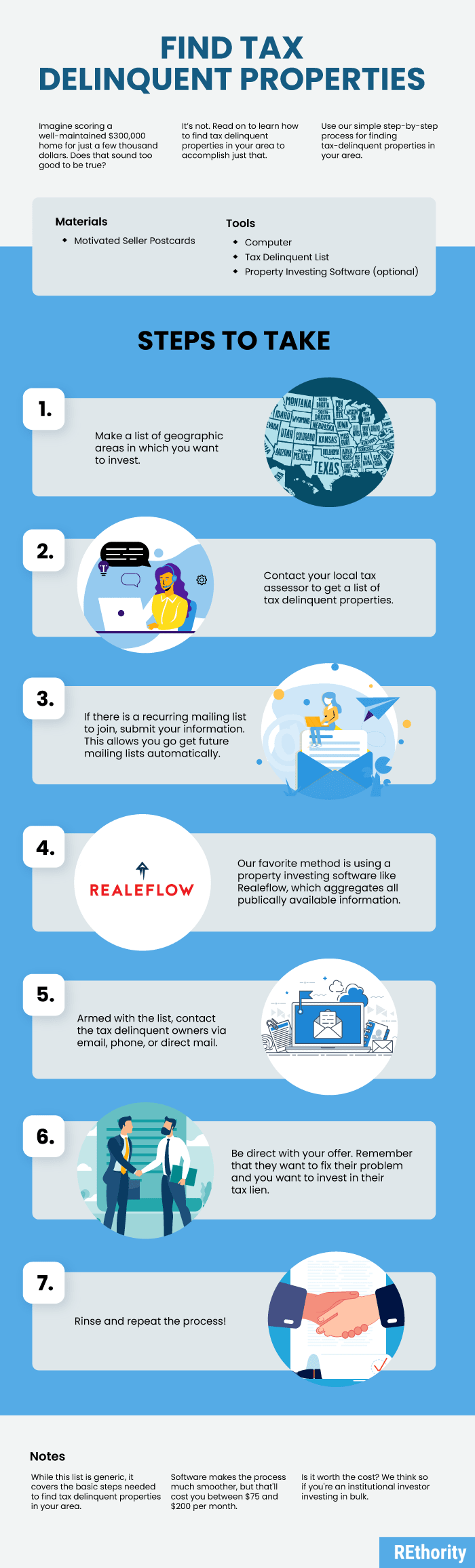

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax California H R Block

How To Calculate Property Tax And How To Estimate Property Taxes

141 Upper Cove Rd Mathias Wv 26812 Mls Wvhd104652 Zillow Estate Homes Old Houses Real Estate

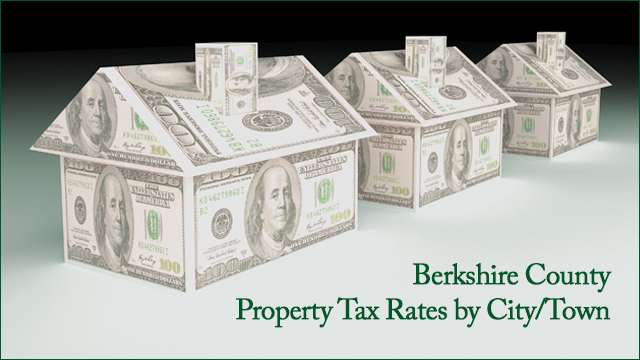

2021 Property Tax Rates For Berkshire County Berkshirerealtors

2022 California Property Tax Rules To Know

Riverside County Ca Property Tax Search And Records Propertyshark

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire